Investing with

a conscience.

A Single Family backed investment platform that supports exceptional entrepreneurs and fund managers in building & growing leading businesses that will shape the future for the better.

Trusted &

Active Investor

KAAF is committed in building long-term relationships with all our stakeholders! We proactively support our portfolio businesses and fund managers.

High-conviction

Approach to Investing

KAAF manages concentrated and high-conviction portfolios across its investment platform. Investment process is fully based on bottom-up fundamental research and long-term value creation.

Sustainable

Wealth Creation

KAAF’s diverse and defensive portfolio will need to preserve shareholders’ capital in tough economic climates and grow their wealth over time. Ensure long-term viability and sustainable financial performance.

At KAAF, we do much

more than simply

provide capital.

KAAF was established in 2018 and is headquartered in Dubai. The firm has built a portfolio of investments across different geographies, sectors, stages and strategies. We invest our capital and energy into people, companies and funds we believe will shape the future for the better.

KAAF MISSION

Partner of choice and a positive contributor to society at large.

To be the partner of choice for management teams that are motivated to achieve their full potential and to be a positive contributor to society at large. We drive sustainable change in businesses to scale and ultimately impact people’s lives for the better. We help companies realize their full potential through capital, support and long-term strategic guidance. Moreover, KAAF targets to be a gold standard employer that attracts the best talent with a deep understanding of investments. We bring together people with different skills and backgrounds to build a sustainable and scalable investment platform.

KAAF MANDATE

Structural value creation whilst managing risk

KAAF manages proprietary capital, that seeks to identify and pursue quality opportunities that create “alpha” whilst managing risk. In a constantly changing business environment in which new innovative businesses emerge daily and trends change rapidly, we source global investment opportunities within a variety of sectors, asset classes and strategies to deliver positive returns to our shareholders.

Meet our Shareholders

Primary role of the shareholders is to provide strategic direction and oversight of the organisation. The owners also sit on the Investment Committee (“IC”) alongside our leadership team and independent committee members.

Mishal Kanoo

Chairman

Mishal is one of the most iconic business figures in the Middle East and has a reputation as a futurist and strategist with a strong track record in forecasting economic developments in the region. As Chairman of KAAF Investments, Mishal Kanoo tries to help people reach their professional dreams. Playing a role in bettering people’s lives is a great instigator for doing what he does. Kanoo has been investing on a personal and company level since 1991.

Maha Kanoo

Vice Chairwoman

Maha is a member of the Investment Committee and serves as the General Manager for Administration & HR of KAAF Investments. Maha joined the Kanoo family business first in Bahrain and then moved to the UAE as head of HR. Prior to KAAF, Maha has worked at Citibank and Royal Bank of Canada and American Express.

Basem Kanoo

Director

Meet our Leadership Team

Our Team consists of highly qualified leaders who bring their experience and expertise to the benefit of our company.

Filmon Ghebrihiwet

CIO

Filmon has over 15 years of experience in the M&A, PE and VC space. Over the years, he has been investing both into liquid and illiquid strategies. Filmon has worked at multiple family offices and sits on several boards. As the CIO and IC member at KAAF Investments, Filmon manages the direct, alternative and liquid investments portfolios.

Filmon holds an MSc from Nyenrode Business University and an Executive Master in Finance and Control from the same institution in the Netherlands.

Nandi Vardhan Mehta

CFO

Nandi is a seasoned finance professional with over 16 years of Senior Management experience in the Middle East. Having a firm belief in impact investing he joined KAAF to help groom businesses of tomorrow which will contribute immensely to the region. As the CFO & IC Member at KAAF, Nandi is responsible for the Company’s Finance, Tax, Corporate Affairs, and Treasury functions. Nandi is an active early-stage investor and sits on Several Boards across countries. Nandi is an Indian Chartered Accountant and hold BCom (Hons) from JNVU, India.

Our Values

KAAF Investments’ core principles that underpin the way we do business:

Analysis

We have an analytical and determined approach to finding the most attractive investment opportunities and to deliver high returns to our shareholders. Develop independent opinions on investment themes and managers and act with conviction.

Risk Management

Mitigate risk through thoughtful portfolio construction. Diversification across top emerging and established managers along with high-conviction direct investments across sectors, stages and geographies provide high risk adjusted returns.

Sustainability

We recognize the importance of responsible investment and sustainability plays a major part in the way we build long-term business success. Each due diligence process will include an analysis of Environmental, Social and Governance factors.

Partnership

We are committed to working in close collaboration and trusted partnership with all our stakeholders. We will address the needs of our portfolio companies. We will continue to strengthen our GP relationships by being an engaged, value-add partner.

Contribution

We are committed to making a positive contribution to society by helping to build strong, sustainable companies; creating jobs; and strengthening communities.

Culture

Our culture is based on teamwork, integrity, and meritocracy. Our deep understanding of markets, passion for investments and values inspire everything we do.

Investment Approach

KAAF’s flexible platform offers the ability to build a diversified portfolio across geographies and the stages of the investment spectrum from early, growth to mature businesses

Team has an extensive deal & fund sourcing network across the globe. We also use several benchmarking tools to identify top performing funds

Our investment strategy is relatively simple: we manage concentrated and high-conviction portfolios across:

1. Liquid strategies

2. Illiquid strategies

2. Illiquid strategies

Investment process is fully based on bottom-up fundamental research and long-term value creation. In the Liquid space our portfolio typically consists of between 5 to 10 high-quality businesses, holding positions which are “long only”. Whilst in the Illiquid space we place great emphasis on leadership, organisational culture, competitive advantages, growth and other criteria.

When it comes to funds, we first select the strategy that we want exposure into. Subsequently we will identify the best performing fund managers for that strategy and connect with them. Based on our analyses we will then select the manager for that particular strategy.

Partnerships with like-minded investors such as other family offices and institutional investors has helped create good deal flow both in terms of funds and investments into companies. Moreover, a strong network of entrepreneurs, brokers, placement agents across the globe have also provided us access to highly sought-after deals and funds.

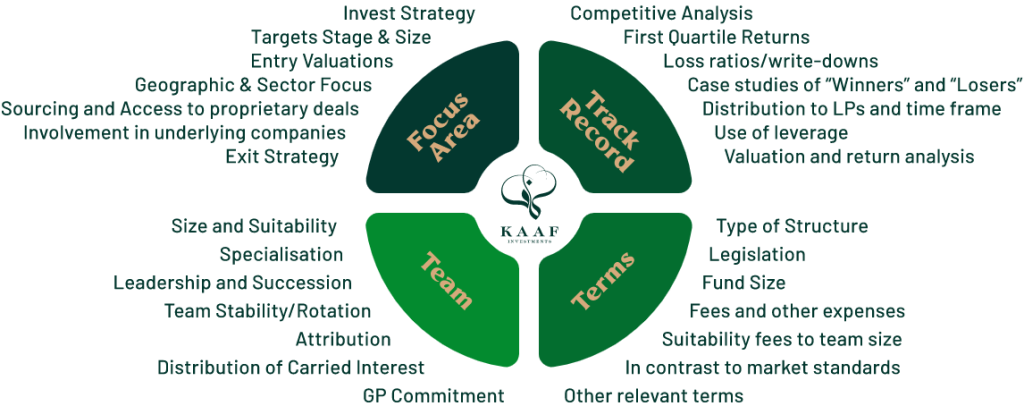

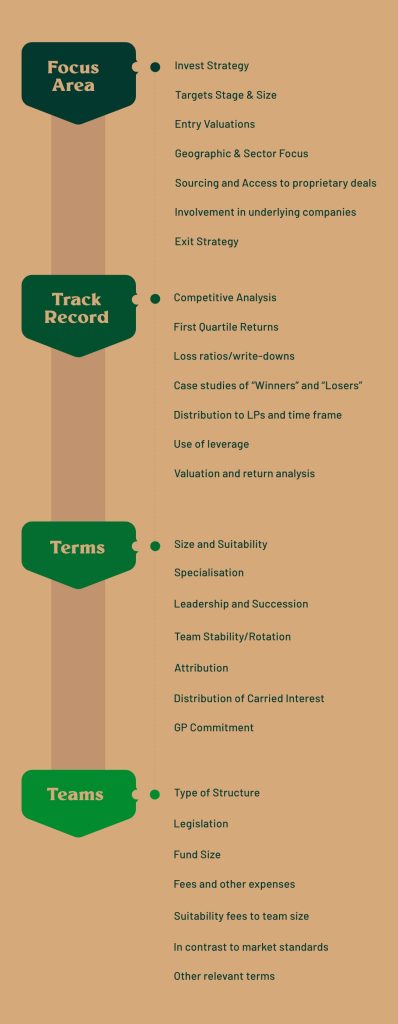

Fund Selection

Our relationships with leading GPs and our proprietary approach to evaluating and selecting high-potential managers is the cornerstone of KAAF.

Flexibility

In targeting deals with high risk-adjusted returns instead of being “boxed” by investments that fit the criteria.

Portfolio

A sustainable portfolio that is characterized by growth, diversification and high returns

Core of KAAF’s investment strategy centres around allocating proprietary capital into a concentrated portfolio of businesses and funds that are expected to deliver value over the long-term. Our investment business is primarily focused on the private markets although we have a listed equities portfolio as well.

KAAF directly invests in well-run businesses across a range of sectors, primarily focusing on

Renewable Energy

Healthcare & Wellness

Consumer

Technology and

Financial Services

KAAF has also built a portfolio of 3rd party managed Private Equity (“PE’) and Venture Capital (“VC”) funds.

Investment decisions are geographically agnostic and can be split into Developed, Emerging and Frontier Markets. Majority of our capital is invested in Developed Markets.

Public & Private

(co-) Investments

Venture Funds

Private Equity Funds

Private Debt Funds

Hedge Funds

Media

Articles

Stay updated on the latest news from KAAF and its portfolio of companies

Previous

Next

Videos

Podcast

Contact Us

KAAF Investments, P.O. Box 290, Dubai

Careers

Join Us

We are always on the lookout for people with great talent and virtue to join KAAF and help drive it towards its mission to be the partner of choice for management teams that are motivated to achieve their full potential and to be a positive contributor to society at large

Get in Touch

To register your interest, please send us your CV along with a cover note.

© 2022 Kaaf Investments | kaafinvestments.com

Menu